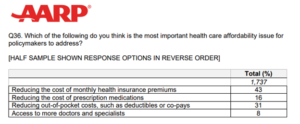

AARP’s own research shows health insurance premiums, deductibles and co-pays as the most important healthcare costs people want policymakers to focus on. Yet, AARP is seemingly silent on these priority concerns compared to others. Why is that?

Source: aarp.org

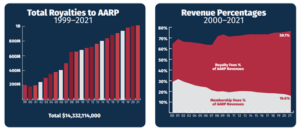

A recent study conducted by Chris Jacobs of Juniper Research Group, may help answer that question by explaining the multi-billion dollar financial partnership between AARP and UnitedHealth Group), the nation’s largest insurer. Jacobs explains that this lucrative relationship, which totals more than $8 billion in profits over the last 15 years, compromises AARP’s policy stances, despite the negative impact they could have on seniors.

AARP is willing to put its own bottom line and that of its corporate financial partners before seniors by supporting bills like the Inflation Reduction Act that raids nearly $300 BILLION in promised Medicare drug savings to fund costly electric vehicle handouts and subsidies unrelated to Medicare (including billions for big health insurer-PBM corporations, including UnitedHealth). Yet, when it comes to the most pressing cost concerns exposed in their own research (lowering insurance premiums, deductibles and copays) AARP appears almost AWOL.

It’s time to ask who and what does AARP really advocate for these days?

Learn More:

Kimberly A. Strassel: Whom Does AARP Serve? (The Wall Street Journal, 8/4/22)

Chris Jacobs: Congress Should Investigate AARP (Inside Sources, 1/22/23)

Fred Schulte: AARP’s Billion-Dollar Bounty (Kaiser Health News, 6/6/22)