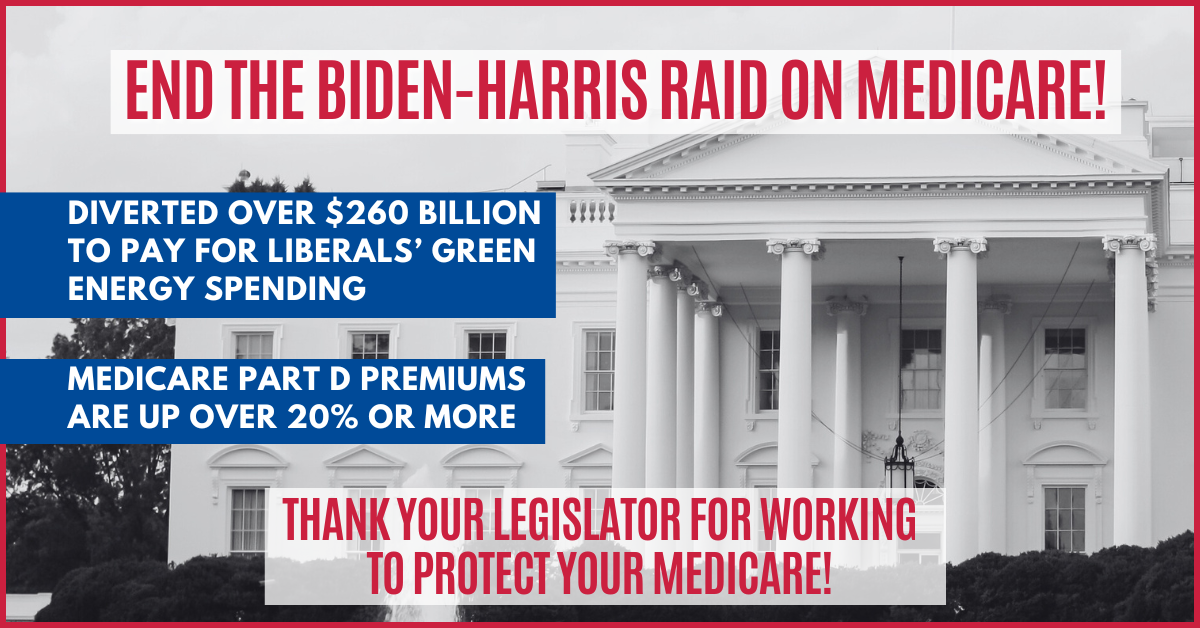

Commitment to Seniors Launches Campaign Urging Congress to Pass the Senate Finance Committee’s Bipartisan PBM Reforms in Any Congressional End-of-Year Legislative Package

CONTACT: Michael DeSantis michael@americancommitment.org Passing S.2973 and S.3430 Will End the PBM Kickback Scheme and Deliver Real Savings to Seniors Washington, D.C. — November 12, 2024 — Commitment to Seniors, a project of American Commitment, has launched a national and multi-state grassroots mobilization and paid media campaign urging Congress to ACT NOW and pass the Senate Finance Committee’s bipartisan Pharmacy Benefit Manager (PBM) reforms, S. 2973 and S. 3430, to deliver real savings to seniors.…

Learn More